Santander UK Explains SWIFT Codes for Secure Transfers

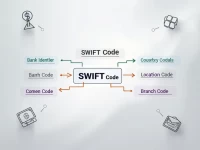

Understanding the SWIFT code ABBYYGB2L DOC of SANTANDER UK PLC is crucial for ensuring the safety and accuracy of international remittances. This article discusses the functions of the SWIFT system and its significance in international financial transactions, advising readers to verify the SWIFT code when making transfers to avoid delays and misdeliveries.